In Sept 2020, RBI issued guidelines to credit card and debit cards to prevent fraud andsecuritylapses.

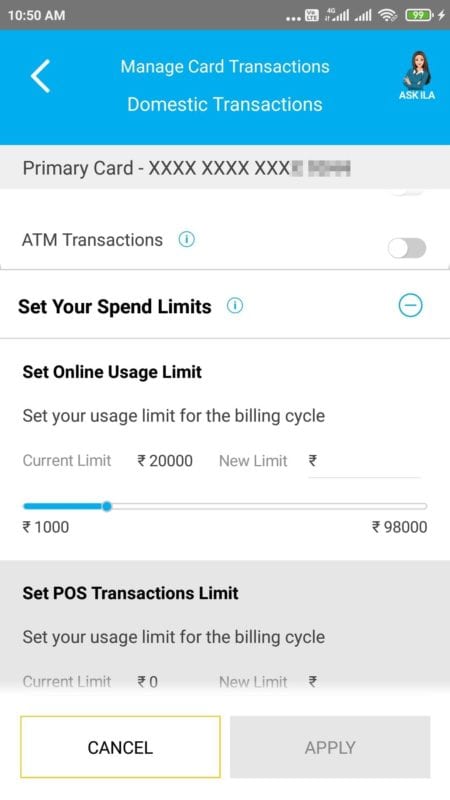

you’re able to opt-in or opt-out for each category of transaction and set Spend limits.

for international transactions, online transactions as well as contactless card transactions.

Steps to manage your SBI credit card usage for domestic and online transactions in India.

This applies to SBI credit cards also.

Before Oct 1st, 2020, there are default limits for your domestic and international transactions.

UsingWindows 10and Chrome, you could set the spend limit for each category pop in.

You also see that alert or notification in your SBI credit card dashboard.

How to Set Transaction Limit on your SBI Credit Card

Time Needed:3 minutes.

Steps to manage your SBI credit card usage for domestic and online transactions in India.

If you have only one, it is automatically selected.

Otherwise, you have to pick the card for which you want to change.

This will make it blue.

To opt-out, you’re free to move it left and will look grey.

In this case, I have set the limit to Rs 20000.

In that case, it’s possible for you to keep the option of Online Transactions open.

Using this category, you better swipe the credit card.

Then, you have to enter a PIN.

SBI credit cards have also issued contactless payments in 2020.

The card picks up the radio signals or uses RFID technology.

Transactions in close physical proximity.

Quick and for small payments.

To improve security, you’ve got the option to opt-out of this transaction jot down.

The normal usage of cards to withdraw cash is using ATM cards.

A small fee deducted when you use SBI credit card for this purpose.

This is useful when out-of-cash.

But to prevent fraud or lost or stolen cards, you could disable this punch in.